The US government's "data blackmail" finally succeeded. More than 20 semiconductor companies handed in data. How to deal with the data of Chinese enterprise customers?

Data extortion

According to a number of Taiwan media reports, a TSMC spokesperson said that in order to continue to support the global semiconductor supply chain challenge, TSMC has responded to the US Department of Commerce's request for "semiconductor supply chain risk soliciting public opinion" to help face this challenge.

The dust settled. Before the November 8th deadline set by the US government, all required companies submitted data, and no company explicitly rejected it.

Some large companies probably regretted participating in such a meeting. Not only did they fail to get any benefits, but they also showed their core data to others.

According to media reports, on September 23, the US government communicated with leading companies in the global semiconductor industry through a conference call, with the aim of finding a solution to the current global chip shortage crisis. After the meeting, the Bureau of Industrial Security and the Office of Technology Evaluation of the US Department of Commerce issued a notice on "Semiconductor Supply Chain Risk Public Comment", including a questionnaire covering 26 questions.

Source: US Department of Commerce official website

According to reports from insiders in the US government, this questionnaire was sent to more than 20 related companies, including well-known chip design and manufacturing companies such as TSMC, Samsung, SK Hynix, Intel, and Micron, as well as material suppliers. And downstream equipment vendors.

The questionnaire covers everything from product design and production to the purchase and use of equipment and materials, as well as shipment status, inventory status, supply capacity, customer information, and even the power of the chief executive and the degree of operational intervention.

Although the enterprise resists, it is powerless to resist

When the questionnaire was first sent to companies, the US government stated that it was a voluntary questionnaire, and the data would not be disclosed or made public. But then he said that it will depend on the quality of the data submitted by each company to decide whether to take mandatory measures to obtain the necessary data to help sort out the problem of semiconductor shortages. And, U.S. Secretary of Commerce Gina Raimondo (Gina Raimondo) said, “If companies are unwilling to submit, there are other ways in our (policy) toolbox for them to give us the data.”

The questionnaire involved many commercial secrets, which made the relevant companies very resistant. For example, for a foundry, the disclosure of information on process nodes, yield, inventory, capacity and other information means that its advanced process has no secrets at all, and it loses bargaining power with customers, which puts the company at a disadvantage in the competition. status. As an industry insider who did not want to be named said: "The scope of the US government's data requirements is so large that if all the information it wants is leaked, it will disrupt competition and make it easy for customers to choose a chip manufacturer. Not another one."

What is the purpose of the US government in doing this? Relevant departments of the US government have pointed out in a blog post that “the ability of a single company to adjust quickly in the face of shocks may be restricted by the dynamics of the industrial chain, including the lack of communication and trust between manufacturers in the supply chain. The government has a unique ability to solve this problem. Coordinating challenges and acting as a reliable source of data. This role is particularly important in times of shortage, to deal with downstream companies over-ordering or stockpiling, and upstream companies unable to complete orders due to lack of trust, which will lead to workers who ultimately rely on these products , Households and small businesses are experiencing shortages, delays, price increases and uncertainty."

To find out whether there is a shortage of stocks, stockpiling, etc., the first step is to find out how many chips are produced in the industry. From the perspective of corporate attributes, companies such as TSMC, Samsung, SK Hynix, Intel, Micron, and Infineon are either foundry or IDM, and they control the source of industry data.

Judging from the current news, the three companies that are most conflicting with the submitted data are TSMC, Samsung and SK Hynix. Among them, TSMC is a foundry, SK Hynix is a storage plant and IDM, and Samsung is a foundry, storage plant and IDM.

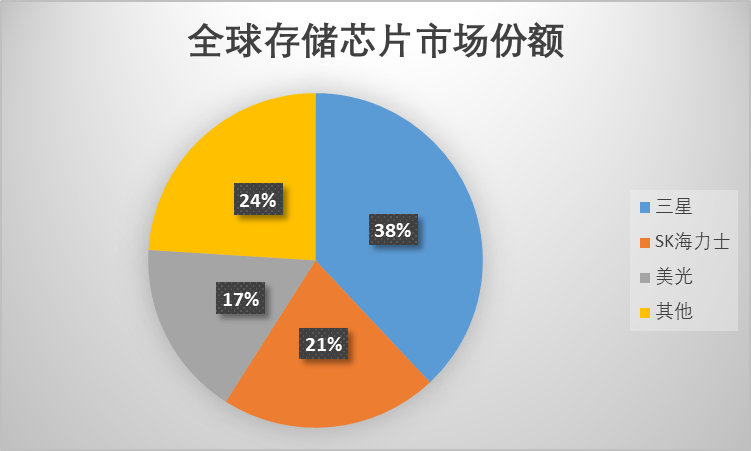

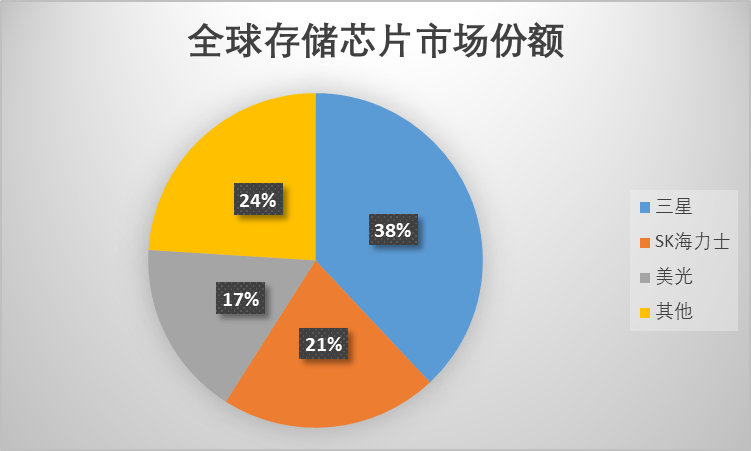

Statistics show that Samsung and SK Hynix are the top two storage vendors in the world. Samsung has the largest market share of 38%, and SK Hynix has 21%.

Data source: TrendForce, electronic enthusiast graphics

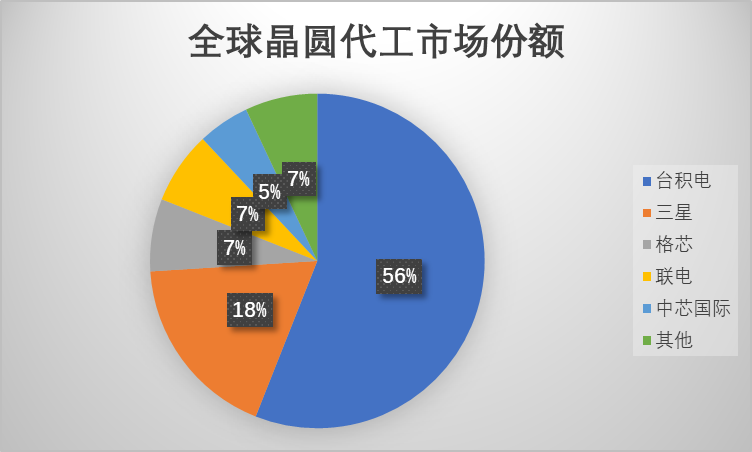

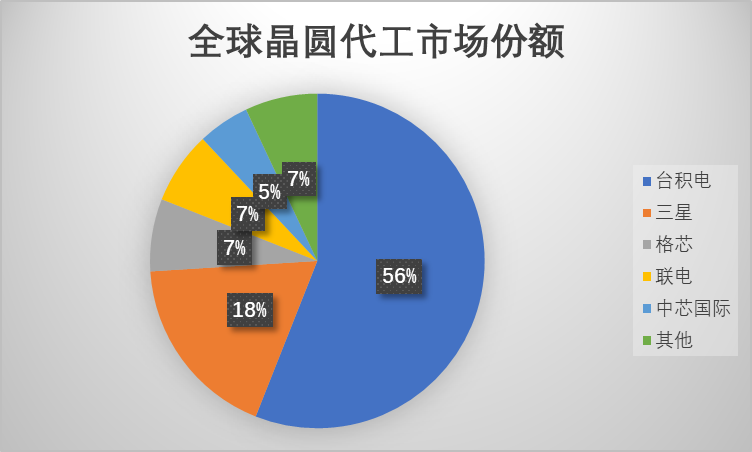

And TSMC and Samsung are the world's top two foundry companies, of which TSMC, the leading foundry, accounts for 56%, and Samsung accounts for 18%.

Data source: TrendForce, electronic enthusiast graphics

What is the impact of submitting data? South Korean media have published reports saying that such things as the sales proportion of the top three customers of each product, supply countermeasures when there is too much demand for specific products, and whether new investments will be made to solve the shortage of semiconductors, etc., these are all first-level secrets of the company. Open to investors. Moreover, if customer information is leaked, it will not only damage their relationship with customers, but also bear huge amounts of compensation.

Prior to this, the external statements of the three companies showed that they were hesitating. Samsung Electronics vice chairman Kim Kim Nam once said: "I am considering various factors and respond calmly."

Lee Seok-hee, CEO of SK hynix, said: "We are discussing internally and are actively communicating with the government."

TSMC first stated: "TSMC will not leak sensitive information." Then it said: "The information will be submitted before November 8." Later it added: "No confidential data will be provided."

However, no matter how the companies resist, the overall situation is now set. All companies have not dared to go against the will of the US government and choose to submit data, including TSMC, Samsung and SK Hynix.

Is the data of Chinese enterprise customers handed in or not?

The purpose of the U.S. government’s request for data has already indicated that “a semiconductor supply chain crisis will occur every 3.7 years in the world, and a new set of supply chain resilience mechanisms are needed. The early warning system for the semiconductor industry, led by the U.S. government to coordinate trading partners and major manufacturers, has become a brand-new entry link in the semiconductor industry and runs throughout."

Regarding the quality of the data, US government officials have repeatedly reiterated that they will determine whether any companies want to prevaricate based on the quality of the submitted data. The meaning is actually very clear, that is, these leading companies need to choose between the unattractive US government and the untouchable commercial red line. Although South Korean semiconductor companies once wanted the South Korean government to help reject this request, a relevant person in charge of the South Korean government recently stated: "We will cooperate with the United States in the entire semiconductor field and plan to switch to a US-South Korea cooperation model to restore the supply chain. healthy."

Since the data must be handed in and cannot be discounted, the data of these manufacturers' Chinese corporate customers will become "sensitive information."

Obviously, if the United States only obtains the manufacturing and shipment data of the chip factory, plus the use data of a US car company, there is no way to understand the global chip supply chain, the major wafer foundries and the customers of IDM manufacturers. Data is the key to completing this work, and this will include data from Chinese companies.

According to statistics disclosed by CCTV Finance, China has been the world's largest semiconductor consumer market for many years. The global semiconductor market will reach 440 billion U.S. dollars in 2020, of which the Chinese market accounts for 34.4%, the United States, Europe, Japan and other markets. The shares are 21.7%, 8.5%, 8.3% and 27.1% respectively.

The US government cannot compulsorily obtain data from Chinese companies, but it can derive this key data through layered data deduction. It is hard for us not to think that the new semiconductor supply system that the US government wants to build is to exclude Chinese companies. Even if it cannot be ruled out, commercial cooperation must be carried out under the supervision of the US government.

Looking at the recent policies of the US government, its idea of cracking down on China's high-tech industries has not been concealed. The NCSC (National Security Council) Press Office previously stated, “In view of the unique opportunities and challenges presented by emerging technologies, NCSC announced today that it is prioritizing the selection of a few technical fields that pose major risks to the U.S. economy and national security. Foreign cooperation investigations in related industries. These fields include but are not limited to artificial intelligence, bioeconomy, autonomous systems, quantum information science and technology, and semiconductors."

Source: NCSC official website

Then, a semiconductor industry chain that is one-way transparent to the US government is extremely detrimental to China's technological development.

At present, the public statement of all companies is that the data submitted does not contain confidential customer data. According to related reports, ASE left most of the sensitive issues blank, Tower Semiconductor did not mention customer names, and only talked about specific industries. ASE also left most of the columns blank. Coupled with Samsung and SK Hynix's "not very detailed", and TSMC's "protect customer information." Can such data satisfy the US government? Come to think of it, the U.S. government is unlikely to have loud thunder and little rain. Customer data, including Chinese corporate customers, is the focus of this game.